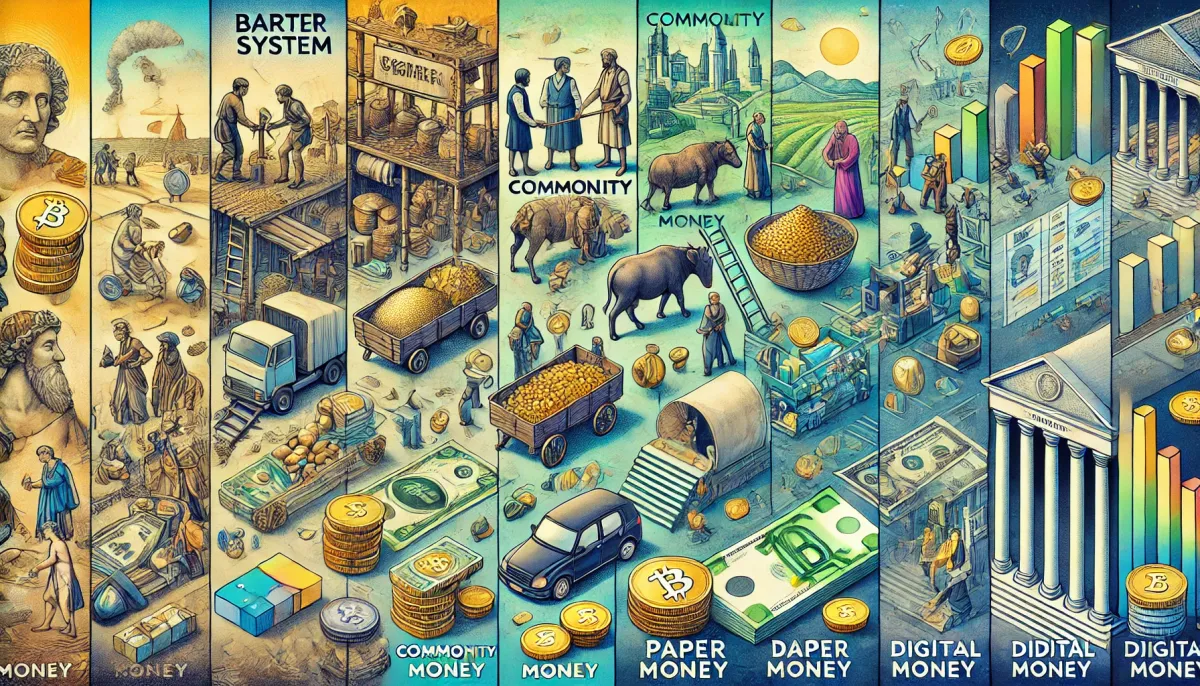

The Evolution of Money and Economy: A Journey Through Time

Explore the fascinating journey of money and the economy, from barter systems to cryptocurrencies. Learn how each era—commodity money, metal coins, paper notes, and digital finance—reshaped trade, solved problems, and paved the way for the future.

Money and the economy are at the heart of human civilization. From the days of barter to #new the rise of cryptocurrencies, every system reflects humanity's attempts to solve specific problems, adapt to changing circumstances, and build a better society. This article dives deeply into the evolution of money and the economy, exploring why changes occurred, the contributions of different regions, and the pros and cons of each system.

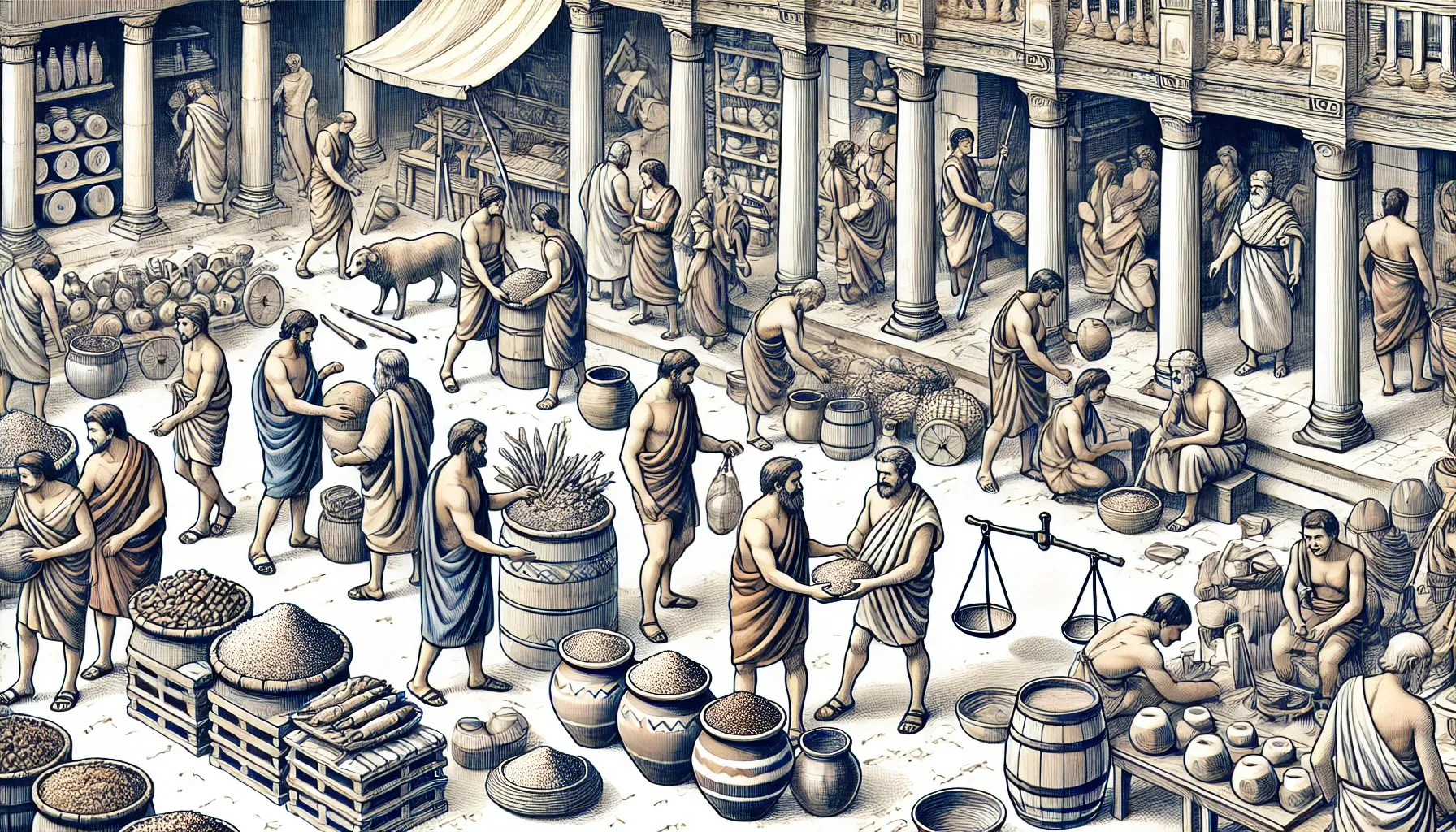

1. The Barter System: The Genesis of Trade

The Concept

In the earliest human societies, people engaged in direct exchange of goods and services, known as the barter system. This simple system sufficed in small, close-knit communities.

Examples Across the World

- Mesopotamia: Farmers traded grain for tools with blacksmiths.

- Africa: Tribes exchanged cattle for salt and other necessities.

- Native America: Tobacco, beads, and maize were used in trade.

Why It Emerged

Barter provided a straightforward way for early humans to trade surplus goods.

Challenges That Triggered Change

- Double Coincidence of Wants: Both parties needed to want what the other offered.

- Example: A potter might need meat, but a hunter might not need pots.

- Indivisibility of Goods: Some items couldn’t be divided for smaller trades, like a cow for a handful of grains.

- Perishability: Many goods, such as food, couldn’t be stored for long periods.

Pros

- Simple and direct.

- No inflation or complex systems.

Cons

- Highly inefficient in larger societies.

- No standard measure of value.

2. Commodity Money: Assigning Value to Objects

The Concept

To overcome the limitations of barter, societies began using commodity money—items with intrinsic value that were widely accepted.

Examples Across the World

- Cowrie Shells: Used in Africa and Asia due to their rarity and beauty.

- Salt: In the Roman Empire, salt was so valuable it was used to pay soldiers.

- Cacao Beans: In the Aztec Empire, cacao beans served as currency in bustling markets.

Why It Emerged

A universal medium of exchange was needed to simplify trade.

Challenges That Triggered Change

- Portability Issues: Heavy or bulky items like livestock made long-distance trade difficult.

- Fluctuating Value: Commodity values were influenced by supply and demand.

Pros

- Universally accepted within communities.

- Some commodities, like metals, could be stored long-term.

Cons

- Limited portability.

- Inconsistent valuation.

3. Metal Coins: The Birth of Standardized Currency

The Concept

Metal coins, made from gold, silver, or copper, became a standardized medium of exchange. Governments and rulers stamped coins to certify their weight and value.

Examples Across the World

- Lydia (Turkey, 600 BCE): Introduced the first coins made of electrum.

- China: Developed bronze coins with square holes, making them easier to string together.

- Roman Empire: The denarius became a universal coin in Europe and the Mediterranean.

Why It Emerged

Metal coins were durable, portable, and easier to standardize than commodity money.

Challenges That Triggered Change

- Dependence on Resources: Societies needed access to precious metals.

- Counterfeiting: Coins were often forged, undermining trust in the system.

Pros

- Portable and durable.

- Facilitated large-scale and international trade.

Cons

- Resource-intensive to produce.

- Vulnerable to forgery and theft.

4. Paper Money: Lightweight Innovation

The Concept

Paper money started as promissory notes and evolved into government-issued currency. It was lighter and more portable than coins.

Examples Across the World

- China (Tang and Song Dynasties): Pioneered promissory notes and government-backed paper currency.

- Islamic Empires: Letters of credit (suftaja) facilitated trade across vast regions.

- Europe: During the Renaissance, banks began issuing promissory notes, precursors to modern banknotes.

Why It Emerged

Transporting large quantities of coins became impractical for expanding trade networks.

Challenges That Triggered Change

- Trust Issues: Paper money required trust in the issuer.

- Inflation: Overprinting could devalue currency.

- Example: Hyperinflation in Yuan China (13th century).

Pros

- Lightweight and convenient for large transactions.

- Encouraged international trade and investment.

Cons

- Prone to inflation if mismanaged.

- Relied heavily on trust in central authorities.

5. Banking Systems: Managing Wealth and Credit

The Concept

Banks emerged as institutions to store wealth securely, provide loans, and manage economic transactions.

Examples Across the World

- Mesopotamia: Temples acted as early banks, storing grain and silver.

- Renaissance Italy: Banking families like the Medici introduced double-entry bookkeeping.

- India: Ancient texts like the Arthashastra described lending systems.

Why It Emerged

Growing economies needed secure storage, credit systems, and centralized wealth management.

Challenges That Triggered Change

- Economic Inequality: Banking concentrated wealth in the hands of a few.

- Risk of Default: Lending practices sometimes destabilized economies.

Pros

- Provided secure wealth storage.

- Enabled large-scale investments and trade.

Cons

- Encouraged inequality and speculation.

- Vulnerable to corruption and crises.

6. Fiat Money: Trust-Based Currency

The Concept

Fiat money is government-issued currency with no intrinsic value, backed solely by trust in the issuing authority.

Examples Across the World

- United States: Abandoned the gold standard in 1971, fully adopting fiat currency.

- Germany (Weimar Republic): Printed fiat money to rebuild after World War I, leading to hyperinflation.

Why It Emerged

The gold standard limited money supply during crises and restricted economic growth.

Challenges That Triggered Change

- Inflation Risk: Fiat money could be overprinted, leading to economic instability.

- Example: Zimbabwe’s hyperinflation in the 2000s.

- Global Trust Issues: Nations rely on stable governments to back fiat currency.

Pros

- Flexible money supply.

- Promotes economic growth during recessions.

Cons

- Inflation and currency devaluation risks.

- Entirely reliant on trust in governments.

7. Digital Money and Cryptocurrencies: The Modern Era

The Concept

Digital money includes online payment systems and cryptocurrencies like Bitcoin, which operate on decentralized blockchain technology.

Examples Across the World

- PayPal and Credit Cards: Revolutionized digital payments globally.

- M-Pesa (Kenya): Brought mobile banking to unbanked populations.

- Bitcoin: Introduced in 2009 as a decentralized currency.

Why It Emerged

Traditional banking systems were slow, expensive, and excluded many from financial systems.

Challenges That Triggered Change

- Volatility: Cryptocurrencies experience dramatic price swings.

- Regulation: Governments struggle to manage decentralized systems.

Pros

- Instant, borderless transactions.

- Financial inclusion for underserved populations.

- Reduced reliance on central authorities.

Cons

- Highly volatile.

- Vulnerable to hacking and fraud.

- Environmental concerns with cryptocurrency mining.

Conclusion: A Cycle of Innovation

The history of money and the economy is a testament to human ingenuity. Each system—barter, commodity money, coins, paper money, banking, fiat currency, and digital money—solved the problems of its time while introducing new challenges. Today, as we embrace digital currencies and blockchain, humanity continues to adapt, innovate, and redefine the future of money and the economy.